Guaranteed Removal in 90 days or full refund + we pay

you $1,000.

Get Personalized Dispute Assistance, Real-Time Updates, and a Path to a Healthier Financial Future

The most up to date methods in disputing inaccuracies, on your report.

At Score Guard, we go beyond simple credit repair. Our team provides you with in-depth credit analysis, tailored dispute strategies, and ongoing education to help you achieve—and maintain—a stronger financial standing.

Target & Dispute Inaccuracies: We thoroughly analyze your credit report and challenge incorrect, outdated, or unverifiable items.

Stay Informed in Real-Time: Get frequent updates so you know exactly where your credit stands and what’s being disputed.

Build Sustainable Habits: Access expert coaching and educational workshops that pave the way for lasting financial health.

Comprehensive Solutions for a Stronger Financial Future

From in-depth credit analysis to debt relief strategies, our range of services helps you tackle every step of your financial journey—confidently and efficiently.

Credit Repair Solutions

We identify and dispute inaccurate or outdated items on your credit reports, helping to restore your credit profile and pave the way for a stronger financial future.

Debt Consolidation Solutions

Lower your interest rates and simplify repayments with our customized consolidation plans—designed to help you regain control of your finances and eliminate debt faster.

Financial Education Workshops

Gain the knowledge and tools you need to succeed with our hands-on workshops covering budgeting, credit management, and long-term financial planning.

Empowering Financial Freedom Through Professional Credit Solutions

Empowering financial stability through personalized credit repair and education.

Comprehensive Solutions for a Stronger Financial Future

From in-depth credit analysis to debt relief strategies, our range of services helps you tackle every step of your financial journey—confidently and efficiently.

Credit Repair Solutions

We identify and dispute inaccurate or outdated items on your credit reports, helping to restore your credit profile and pave the way for a stronger financial future.

Debt Consolidation Solutions

Lower your interest rates and simplify repayments with our customized consolidation plans—designed to help you regain control of your finances and eliminate debt faster.

Financial Education Workshops

Gain the knowledge and tools you need to succeed with our hands-on workshops covering budgeting, credit management, and long-term financial planning.

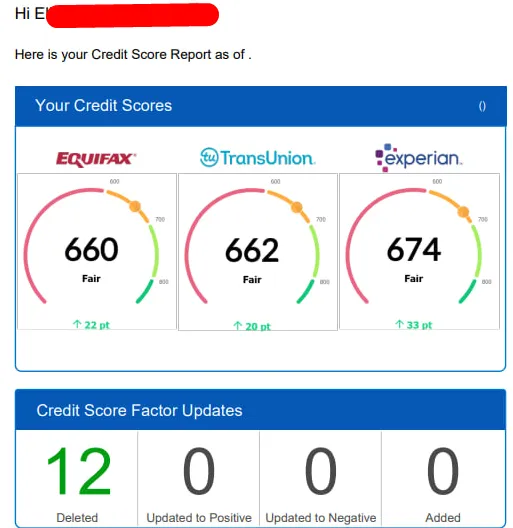

Credit We've Fixed

Frequently Asked Question

Get Answers to Your Credit Counseling Queries Here!

How can Score Guard help improve my credit score?

Score Guard reviews and disputes inaccuracies on your credit reports to improve your score.

What kind of inaccuracies can Score Guard help dispute?

We can help dispute incorrect personal details, duplicated accounts, outdated data, wrongful collections, and identity theft issues.

How long does it typically take to see results

Typically, clients start to see improvements within 90 days from the start of our process

Is working with a credit counseling service like Score Guard safe

Yes, working with Score Guard is safe as we ensure the highest standards of data protection and confidentiality

What is the cost of Score Guards services

Our fees vary based on services required. Initial consultations are free to assess your credit situation.

Can Score Guard help me if I'm facing bankruptcy

Yes, we offer consultancy and strategic planning for individuals facing bankruptcy. Our goal is to provide alternative solutions that might prevent the need for such drastic measures, or to assist in the recovery of your credit score post-bankruptcy.

Copyright © 2025. All Rights Reserved.